As predicted, the Fed raised rates 25 bps to 1.25%. Bank of Bozeman increased some of our rates for deposits. The prime rate increased correspondingly to 4.25%, but long-term mortgage rates are at some of their lowest levels all year. So we have good news for both borrowers and savers – how is that possible?

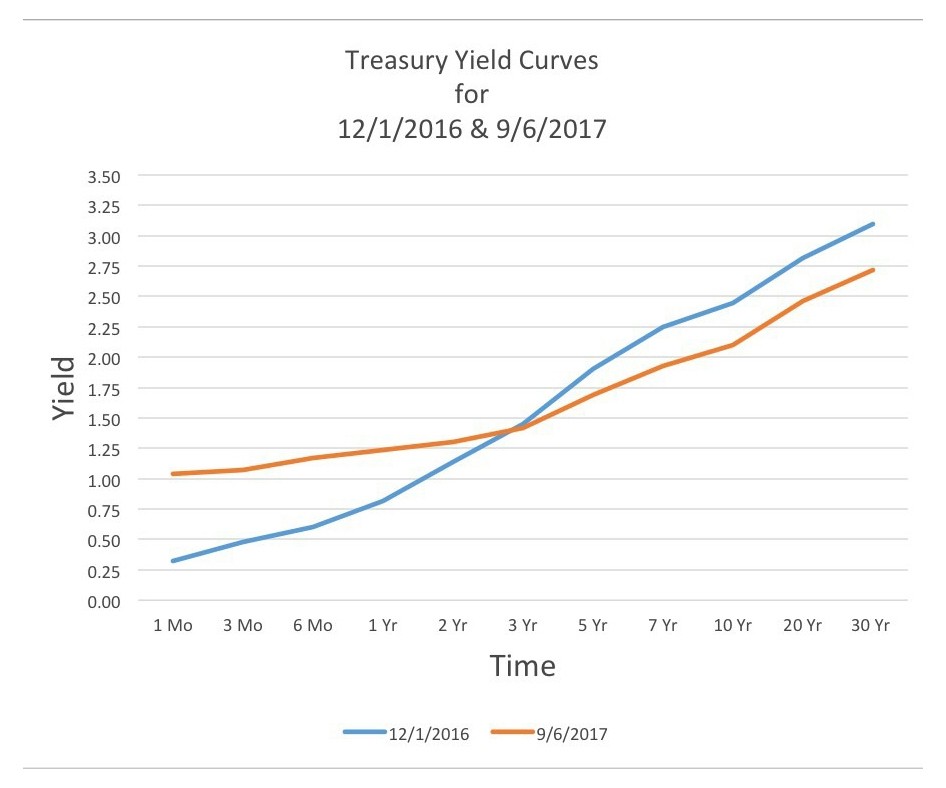

It is a function of a flattening yield curve. The “yield curve” is simply the yield of each Treasury bond along the maturity spectrum plotted on a graph. The yield curve typically slopes upward, since investors need to be compensated with higher yields for assuming the added risk of investing long term. The graph below shows Treasury rates from last December compared to now. You will notice that short term rates are increasing and yet long term rates are dropping and the curve is still sloped upward to the right. The shape of this curve suggests both the Federal Reserve and the public markets believe we are entering a phase of growth with low inflation – just what the doctor ordered.

The Fed may have another short term rate increase in store for this year. If the yield curve gets too flat, the Fed can start to influence long term rates by selling some of its securities. It owns around $4.5 trillion in bonds (yes, trillion), primarily consisting of Treasuries and Mortgage-Backed Securities. So by raising short term rates and selling its bond portfolio, perhaps the Fed can keep us headed toward that goldilocks’ yield curve where depositors get paid more interest and yet borrowers have great rates.

Because most of you have lived through a number of economic cycles, you are probably discounting the likelihood of this ideal yield curve from happening. There always seems to be a major event or two that get us off the right economic path. Or our government takes actions which undermine the economy. As of this moment, it is a good time both to save and to borrow- so come by the Bank and let us help you take advantage of the season!