Compound interest is interest paid on interest already earned on a deposit or loan. Think of it as ‘interest on interest’. For those of you who struggle to pay off credit cards, compound interest is likely the culprit. Interest from the prior month is added to the principal you owe and you’re being charged interest on interest. Before long that $200 pair of shoes can end up costing you $600 or more. That is why many financial advisors recommend eliminating credit card debt.

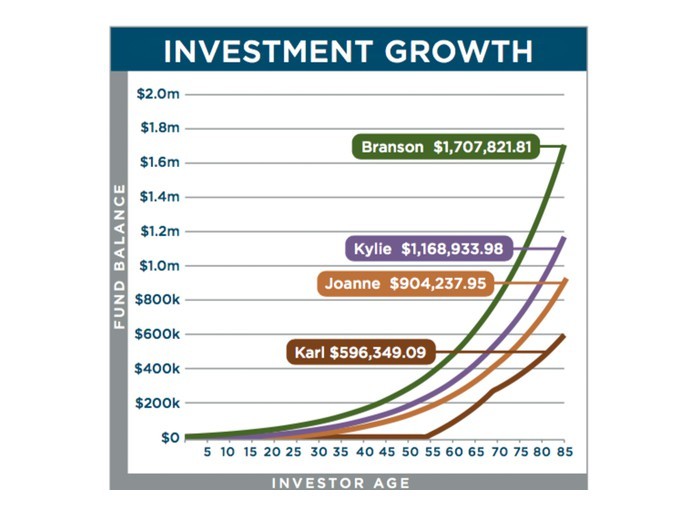

Saving money is a way to turn the tables and have compound interest work for you rather than against you. To gain an understanding of how powerful compound interest can be, let’s look at an example of four hypothetical individuals: Karl, Joanne, Kylie and Branson. We’ll assume an average savings interest rate of 5% over their lifetimes, monthly compounding of interest, and they all stop depositing additional funds at age 70.

Karl is leading a very busy life and feels he has always had too many near- term obligations to save money. First it was buying a car, then paying off his own student loans, then getting married and buying a house, then paying for all the expenses raising kids, then their college….but he has resolved to start saving when the last kid is out of school. So at age 55, Karl starts regularly saving $1,000 every month.

Joanne spent all her money in her youth and incurred many expenses during and right after college that kept her from saving. But at age 25, Joanne starts saving $200 per month.

Kylie started saving as soon as she got her first job at age 15. She and her Dad walked down to her local community bank and opened a minor account for her and she has deposited $150 per month ever since.

Branson’s grandparents opened an account for him the month he was born. They took advantage of the bank’s referral program for new accounts and deposited $100 per month until Branson became 15, then Branson took over the tradition and made the monthly $100 deposits.

The lesson from the illustration (refer to the Investment Growth chart) is obvious: it’s never too late to start saving, but starting early can make a huge difference in achieving financial security. Saving regularly is practicing delayed gratification, and many psychologists view the practice of delayed gratification as a way to help develop emotional maturity.

And unlike the swings of the stock market, your bank account never goes down unless the money is withdrawn. Your money slowly and steadily grows with the assurance that it’s safe because it is covered by the Federal Deposit Insurance Corporation up to $250,000. No one has ever lost money with an account that was FDIC insured – even if the bank went out of business – no one.

Why start saving for your future with a community bank? Local community banks reinvest your money in the community. Start saving with a local community bank, your future self will thank you!

About the Author: Clinton Gerst is the President of Bank of Bozeman, an Independent Community Bank in Bozeman, Montana.

This article is provided for educational and informational purposes only, without any express or implied warranty of any kind, and should not be considered legal or financial advice. All expressions of opinion reflect the judgment of the author as of the date of writing and are subject to change.

You should consult with an attorney or other professional to determine what may be best for your individual needs.